We use cookies to give you a better experience on our website. Learn more about how we use cookies and how you can select your preferences.

Venture capital

Programs

-

Early Stage Venture Capital Limited Partnerships (ESVCLP)

Learn about the tax benefits available for fund managers and investors.

-

Venture Capital Limited Partnerships (VCLP)

Learn about the tax benefits available for fund managers and eligible foreign investors.

-

Australian Venture Capital Fund of Funds (AFOF)

Learn about tax incentives available to Australian Venture Capital Fund of Funds (AFOF) fund managers and investors.

-

Pooled Development Funds (PDF)

The PDF programme helped raise capital and make equity investments in SME Australian business.

-

Biomedical Translation Fund (BTF)

Get funding to develop your biomedical discoveries into a commercial success.

-

Information for registered partnerships

Learn how to manage your reporting, maintain your partnership and get support throughout your journey.

Program news and updates

-

Venture capital newsletter

Subscribe to the free venture capital newsletter to keep up to date with all the latest news and events.

-

Events and information sessions

Events and information sessions to help you understand our venture capital programs.

Other Australian Government support

-

Pitch for venture capital

Learn how to best prepare when seeking venture capital. Get tips on things you can do before you start to maximise your chances for a successful outcome.

-

Tax incentives for early stage investors

The Australian Taxation Office's (ATO) tax incentives for early stage investors program helps to connect early stage innovation businesses with investors who have funds and business experience.

Australian Taxation Office

Registered venture capital funds

-

Find a list of registered and conditionally registered Early Stage Venture Capital Limited Partnerships.

-

See the list of registered and conditionally registered Venture Capital Limited Partnerships.

-

Find a list of limited partnerships registered and conditionally registered as an Australian Venture Capital Fund of Funds (AFOF).

Venture capital statistics

-

Find key statistics on Australian venture capital funds and investments registered under the Venture Capital Act 2002.

-

Find industry-specific data on private capital investment in the domestic market.

Customer stories

-

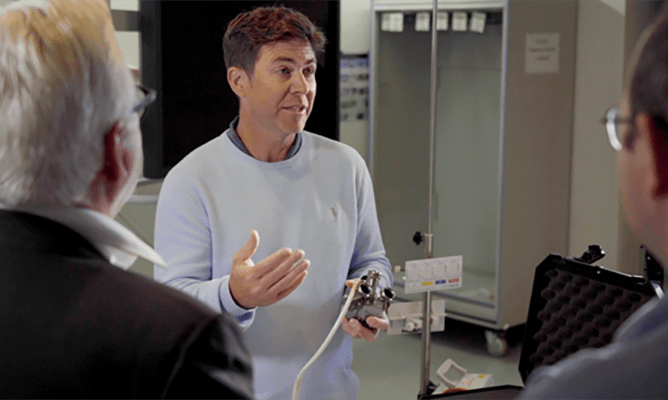

Learn how OneVentures is supporting BiVACOR in developing a medical device that can transform the lives of people with heart disease.

-

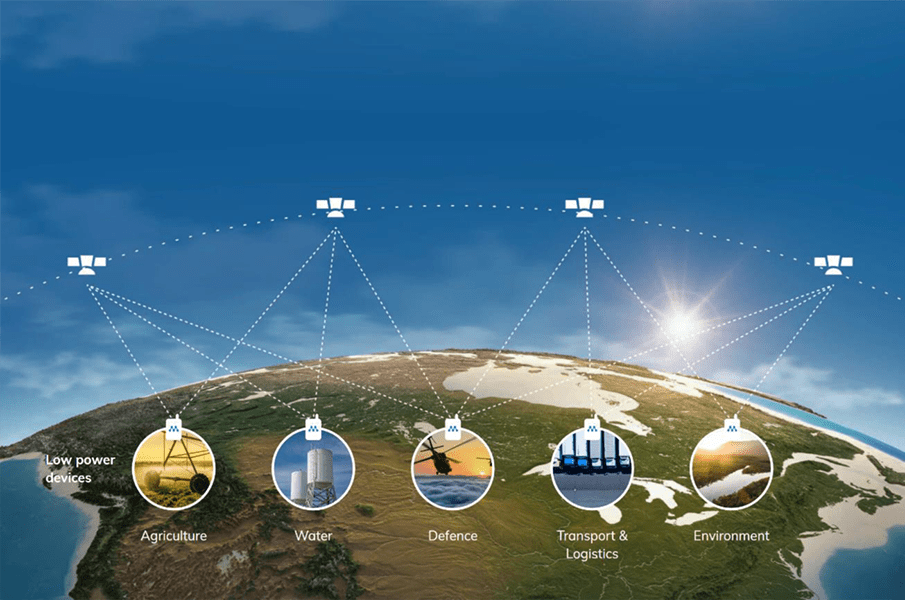

Learn how Right Click Capital is investing in Myriota and its innovations in connectivity.

-

Learn how Brandon Capital supported Aravax to move from research to clinical trials for a new form of immunotherapy.

-

AMSL Aero is developing an efficient electric and zero-emissions vertical take-off and landing (VTOL) aircraft.

-

Learn how Blackbird Ventures supports the Australian start-up community.

-

The tax offset provided through ESVCLPs sweetens investment opportunities.